beginner’s guide to budgeting easy tips for financial success

If my monthly take-home salary amounts to $3,000 or less, how can I effectively manage my expenses for accommodation, food, insurance, health care, debt repayment, and leisure activities without experiencing financial insufficiency? Addressing such a vast volume of information with limited resources is challenging, and this situation entails a zero-sum dynamic.

Create a Financial Budget Plan

A financial plan that projects income and expenses for a given period is called a budget. A budget is a comprehensive financial plan that accounts for every dollar at your disposal. While not magical, it offers more financial independence and a significantly reduced level of stress in one’s life. Here’s the process for creating and managing your budget:

How to budget money

Determine your monthly earnings, select a budgeting technique, and track your advancement.

Use the 50/30/20 rule as a simple structure for budgeting.

Spend no more than half of your earnings on necessities, such as paying the minimum amount owed on any outstanding debts.

Set aside 30% of your income for non-essential spending.

In addition to making the minimal payments required, set aside 20% of your income for savings and debt repayment.

You can better manage and keep an eye on your budget with regular evaluations.

Comprehend the process of budgeting.

Determine your net income after taxes. The amount you get is probably the total if you get paid consistently. To properly calculate your savings and expenses, you should include any automatic deductions you have for savings, health and life insurance, and a 401(k). If you have additional revenue streams, like earnings from freelance work, subtract any elements that lower it, like taxes and business expenses.

Choose a budgeting method: All budgets should include all necessary costs, a portion for discretionary spending, and—most importantly—amounts for both unanticipated events and long-term savings objectives. The envelope method and the zero-based budget are two examples of budgeting plans.

Keep track of your progress. Document your expenses or use digital budgeting and savings tools.

Implement an automated system to save money. Maximize automation to transfer the funds you’ve designated for a specific objective with minimal personal effort. Joining an online support group or having an accountability partner can be beneficial, as it holds you accountable for any decisions that exceed the budget.

Engage in budget management: As your income, expenses, and priorities may change, it is critical to actively oversee your budget by constantly reevaluating it, ideally every quarter. If you are encountering difficulties adhering to your plan, consider implementing these budgeting strategies.

There are minimum payments required for loans and credit cards. The savings and debt repayment category receives any amount exceeding the minimal need.

A Guide to Creating a Budget in Six Straightforward Steps

Step 1: Determine your net income

Your net income is the foundation of a successful budget. Take-home pay refers to the amount of money you receive after subtracting taxes and deductions for programs like retirement plans and health insurance from your total income or paycheck. Emphasizing your gross salary rather than your net income may result in excessive spending because it may create a false perception of having more disposable cash. For those who work as freelancers, gig workers, contractors, or self-employed, it is critical to keep meticulous records of their contracts and earnings to effectively handle fluctuating income.

Step 2: Monitor your expenditures

After determining your income, the subsequent task is to ascertain its allocation. Monitoring and classifying your expenditures can assist you in identifying the areas where you are allocating the most funds and where it may be most convenient to economize.

Commence by enumerating your non-variable expenditures. These are recurring monthly expenses, including rent or mortgage payments, utilities, and car payments. Subsequently, enumerate your variable expenses, which are subject to change every month, such as groceries, fuel, and entertainment. This is a domain where you may encounter possibilities to reduce or decrease. Commencing with credit card and bank statements is advisable, as they frequently provide a detailed breakdown or classification of your monthly expenses.

Document your daily expenditures using any convenient method, such as a pen and paper, a mobile application, or budgeting spreadsheets or templates available on the internet.

Step 3: Establish attainable objectives

Before commencing the analysis of the gathered information, compile a catalog of your immediate and future financial objectives. Short-term goals typically have a duration of one to three years and may involve tasks such as establishing an emergency fund or reducing credit card debt. Long-term objectives, such as accumulating funds for retirement or financing your child’s school, may require several decades to achieve. Keep in mind that your goals are not necessarily fixed, but recognizing them can serve as a source of motivation to adhere to your budget. For example, it could be more manageable to reduce expenses if you are aware that you are setting up funds for a holiday.

Step 4: Formulate a strategic plan

This is the point at which all elements converge: the real amount you are spending vs. the desired amount you wish to spend. Use the combined variable and fixed expenses to gain a better understanding of your projected expenditures in the coming months. Next, contrast that with your net income and priorities. It is advisable to establish precise and attainable spending limitations for every area of expense.

You may opt to further categorize your expenses into necessities and luxuries. For example, if you commute to work daily, gasoline is considered a necessity. A monthly music subscription, on the other hand, could be considered a discretionary expenditure. This distinction becomes significant when seeking methods to reallocate funds toward your financial objectives.

Step 5: Modify your expenditures to adhere to your budget

After recording your income and expenses, you can make any necessary modifications to avoid excessive spending and allocate funds toward your goals. Focus on your desires as the primary target for reductions. Is it possible to forgo movie night instead of watching a movie at home? If you have already made changes to your discretionary spending, it is advisable to carefully examine your monthly payment expenditures. Upon further examination, a “need” may simply be an item that is difficult to let go of.

If the numerical calculations continue to be incongruous, consider modifying your fixed expenses. Is it possible to save money by comparing prices and finding a cheaper auto or home insurance deal? Decisions of this nature entail significant compromises; hence, it is crucial to evaluate your alternatives thoroughly.

Keep in mind that even modest savings can accumulate into a substantial amount of money. The sizeable additional funds you amass by gradually making small changes might surprise you.

Step 6: Regularly evaluate and assess your budget

After establishing your budget, it is crucial to regularly assess both your budget and spending to ensure you are adhering to your financial plan. Your budget consists of only a few fixed components: There are several reasons why you might want to prepare for your financial future. One possibility is that you may receive a salary increase. Another possibility is that your spending may fluctuate. Additionally, you may achieve a specific goal and wish to set new objectives. Regardless of the cause, establish a routine for consistently reviewing your budget using the aforementioned procedures.

FAQ

What are the steps to creating a budget spreadsheet?

Begin by calculating your net income, and then assess your existing spending habits. Lastly, implement the 50/30/20 budget rules, allocating 50% of your income towards essential expenses, 30% towards discretionary desires, and 20% towards both building savings and paying off debts.

What are the methods for maintaining a budget?

To effectively maintain a budget, it is crucial to consistently monitor and record your expenses. This will allow you to gain a clear understanding of your financial allocation and pinpoint areas where you could potentially redirect your funds. Here is the method to begin: 1. Review your account statements. 2. Classify your expenditures. 3. Maintain constant tracking. 4. Consider alternative possibilities. 5. Identify the areas that require modification. Utilizing free web-based spreadsheets and templates helps simplify the process of budgeting.

What is the process for determining a budget?

Commence by conducting a comprehensive evaluation of your financial situation. After determining your current position and setting clear goals, select a budgeting strategy that is suitable for your needs. We suggest implementing the 50/30/20 approach, which allocates your income into three primary categories: 50% for essential expenses, 30% for discretionary spending, and 20% for savings and debt settlement.

Conclusion

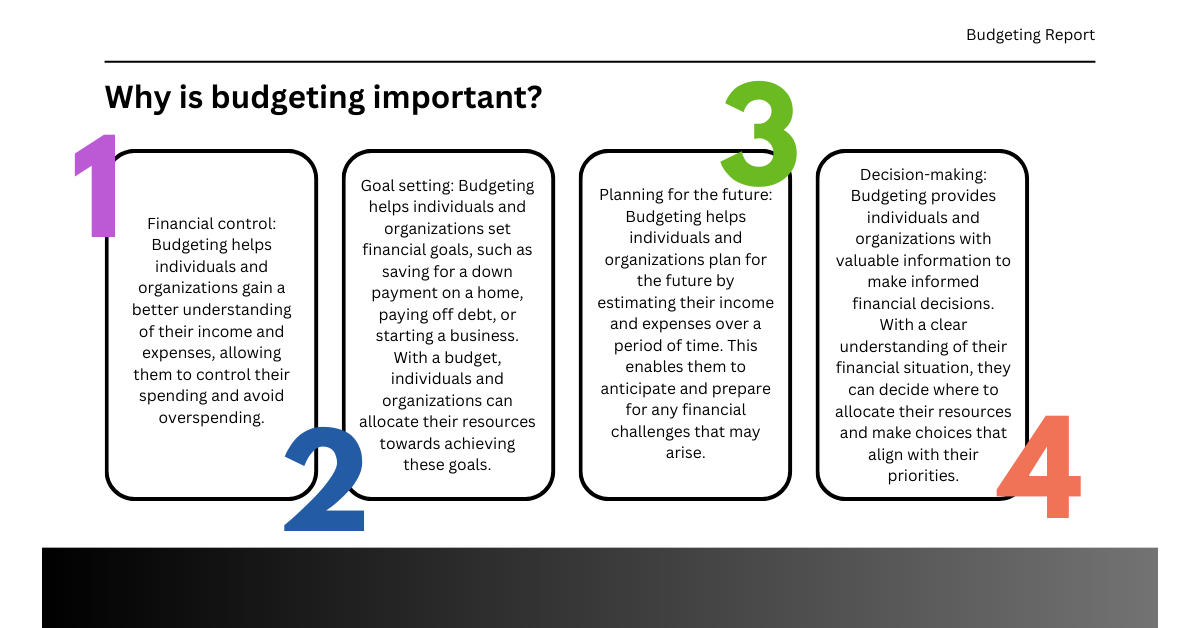

Budgeting is an essential savings tool that helps people properly manage their spending and allocate their finances. The procedure comprises monitoring and classifying both fixed and variable expenses in addition to setting realistic budgetary targets. It is possible to create a strategic plan that prioritizes necessities over-indulgences by comparing these expenses to net income. It is essential to regularly review and analyze the budget to ensure strategy compliance.

To create a spreadsheet for a budget, one needs to calculate net income, assess spending trends, and follow the 50/30/20 budget guidelines. This method sets aside 50% of a person’s income for necessities, 30% for discretionary spending, and 20% for debt repayment and savings. Through diligent and systematic tracking and documenting of expenditures, individuals can get a comprehensive comprehension of their financial distribution and identify specific areas where potential cutbacks might be made. Utilizing costless online spreadsheets and templates helps streamline the task of budgeting.

One Comment