How to Create an Emergency Fund: A Step-by-Step Guide to Financial Security

Introduction: Why an Emergency Fund is Essential

An emergency fund serves as a safety net, safeguarding individuals against unforeseen financial setbacks. The importance of having an emergency fund cannot be overstated, as it plays a crucial role in maintaining financial stability and peace of mind. Life is unpredictable; sudden expenses can arise without warning. These emergencies include medical bills, car repairs, and urgent home maintenance.

An emergency fund helps avoid high-interest debt. When faced with an unexpected expense, many people rely on credit cards or personal loans, leading to significant interest charges over time. By having funds readily available, individuals can address these expenses without incurring additional debt. In this topic, we will cover How to Create an Emergency Fund: A Step-by-Step Guide to Financial Security.

Protection Against Income Loss

Losing a job or experiencing a reduction in income can have devastating effects. An emergency fund provides a financial cushion, allowing individuals to meet their basic needs while seeking new employment or adjusting to a new financial situation. This fund ensures that essential expenses such as rent, utilities, and groceries can be covered without compromising one’s financial well-being.

Stress Reduction

Financial stress can take a toll on mental and emotional health. Knowing that there is a designated fund for emergencies can alleviate some of this pressure. It offers a sense of security, reducing anxiety related to financial uncertainties.

Flexibility and Resilience

An emergency fund grants financial flexibility. It allows individuals to make informed decisions without being rushed or pressured. Whether it’s moving to a new city for a job opportunity or addressing a family emergency, having this financial buffer increases resilience.

Stages of Life and Emergencies

Different life stages come with unique financial challenges. Individuals with dependents face distinct emergencies compared to single adults. For example, parents may need funds for sudden childcare or school-related expenses. An emergency fund is tailored to meet these varied needs, providing support across different phases of life.

An emergency fund is not a luxury but a necessity. It ensures financial stability, reduces stress, and increases resilience in the face of unforeseeable events. The subsequent sections will outline how to build and maintain this crucial financial tool effectively.

Assessing Your Current Financial Situation

Understanding one’s current financial state is pivotal to building an effective emergency fund. The initial step involves evaluating all sources of income and expenses. This detailed assessment provides a clear snapshot of one’s financial health.

- Income Analysis

- Identify all income sources, including salary, freelance work, and passive income.

- Calculate net income after taxes to determine the actual amount available for saving.

- Expense Evaluation

- Categorize expenses into fixed (rent, utilities) and variable (entertainment, dining out).

- Track all expenditures over a minimum of three months for accurate data.

- Debt Assessment

- List all outstanding debts, including credit card balances, student loans, and mortgages.

- Note interest rates, monthly payments, and total amounts owed.

- Savings and Investments

- Review current savings accounts, including high-yield savings and regular accounts.

- Take stock of any investments, such as stocks, bonds, and retirement accounts, to understand liquid assets available in emergencies.

- Credit Score Review

- Obtain the latest credit score and report from a credit bureau.

- Examine for any discrepancies or issues that need addressing to improve financial standing.

- Emergency Fund Calculation

- Determine the necessary size of the emergency fund, which is typically recommended to cover three to six months of living expenses.

- Calculate the gap between current savings and the desired emergency fund size.

- Budget Adjustments

- Identify areas where spending can be reduced or eliminated to free up more funds for emergency savings.

- Consider reallocating current savings or making temporary budget changes to accelerate fund accumulation.

A thorough evaluation of the financial scenario facilitates a realistic approach to building an emergency fund. This groundwork lays the foundation for financial resilience and future security.

Setting Financial Goals for Your Emergency Fund

Establishing financial goals is crucial for building an effective emergency fund. Clearly defined goals enable better planning, saving, and resource allocation. Here are steps to set financial goals for an emergency fund:

- Determine Essential Expenses:

- Calculate monthly living expenses, including rent/mortgage, utilities, groceries, transportation, insurance, and debt payments.

- Identify and list non-negotiable expenses to understand the baseline of required savings.

- Set Savings Target:

- Aim to save 3 to 6 months’ worth of essential expenses as a standard goal.

- Adjust this target based on job stability, family size, and individual risk tolerance.

- Consider an initial target of $1,000 as an immediate, short-term goal.

- Create a timeline.

- Establish a realistic timeline to achieve the savings target.

- Break down the overall goal into smaller, manageable monthly or weekly savings milestones.

- Evaluate the current financial situation to set achievable deadlines.

- Regularly track progress:

- Monitor savings growth regularly to stay on track.

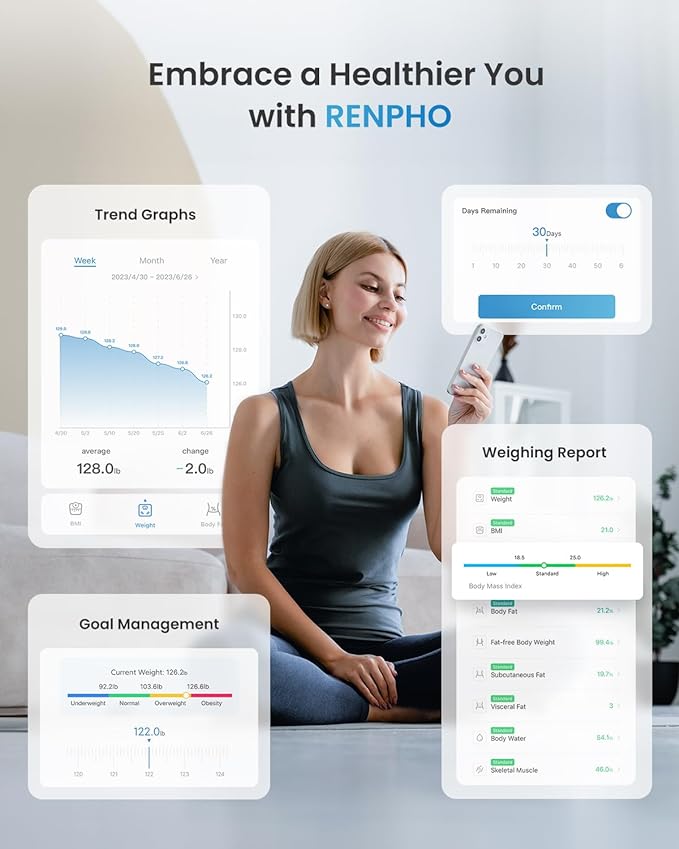

- Use budgeting tools or apps to track contributions and remaining goals.

- Adjust savings strategies if you fall behind milestones.

- Prioritize Contributions:

- Integrate emergency fund savings into the monthly budget as a priority expense.

- Automate transfers to the emergency fund account to ensure consistency.

- Reallocate discretionary spending towards the emergency fund if necessary.

- Review and adjust goals:

- Periodically review financial goals and adjust as life circumstances change.

- Increase the savings target if income rises, a family grows, or significant expenses loom.

- Reassess and recalibrate the timeline and milestones based on current financial health.

- Consider Multiple Income Streams:

- Explore additional income sources (e.g., freelance work, gig economy) to bolster savings.

- Allocate a portion of any windfalls, bonuses, or tax refunds directly to the emergency fund.

Financial goals for an emergency fund should be realistic, measurable, and adaptable. Establishing a clear plan ensures preparedness for unforeseen financial challenges.

Determining the Right Amount for Your Fund

Determining the right amount to set aside in an emergency fund is crucial for ensuring financial security. The appropriate amount depends on several factors unique to each individual or household. Consider the following points:

Assessing Monthly Expenses

Begin by calculating monthly living expenses. This should include:

- Rent/Mortgage Payments: Any ongoing housing-related costs.

- Utilities: electricity, water, gas, and other essential services.

- Groceries: An average monthly cost for food and other household necessities.

- Transportation: gas, public transit, car insurance, and maintenance fees.

- Healthcare Costs: Regular medical expenses, insurance premiums, and out-of-pocket costs.

- Debt Repayments: Monthly payments on any personal loans, credit cards, or other debt.

Employment Stability

Evaluate job stability or the potential for income disruptions. Consider factors such as:

- Job Security: The stability of their current job and industry.

- Backup Employment Options: Prospects for finding a new job if needed.

- Dual Income Households: If both partners are employed, consider each person’s job security.

Personal Circumstances and Lifestyle

Personal situations and lifestyle choices influence the required emergency fund amount.

- Dependents: The number and needs of dependents, such as children or elderly family members.

- Health Conditions: Any chronic illnesses or medical conditions requiring ongoing expenses.

- Lifestyle Needs: Preferences that affect spending, such as hobbies or extracurricular activities.

Recommended Savings Benchmarks

Financial experts typically recommend different savings benchmarks:

- Three to Six Months of Expenses:

- Suitable for those with stable, predictable income.

- Provides a moderate buffer against typical financial setbacks.

- Six to Twelve Months of Expenses:

- It is suitable for self-employed individuals, freelancers, or those with irregular income.

- Ensures more extended security during economic downturns or personal crises.

- Greater Than Twelve Months:

- individuals with higher risk factors, including unstable job markets or significant financial obligations.

- Offers extensive protection against long-term unemployment or major financial disruptions.

Regular Reassessment

Periodically reassessing the required emergency fund amount is essential. Changes in job status, family composition, or financial obligations can necessitate adjustments. Regularly reviewing and updating fund goals ensures ongoing adequacy to meet potential emergencies. Adjustments should be made to reflect any changes in income, expenses, or financial priorities.

By carefully evaluating these aspects, individuals can determine an appropriate emergency fund amount tailored to their specific needs and circumstances.

Next, move on to setting up the fund.

Choosing the Best Savings Account for Your Fund

Selecting the right savings account for an emergency fund is crucial. The following criteria should be considered:

Interest Rates

Evaluating interest rates is essential. Higher interest rates allow the funds to grow over time.

- Annual Percentage Yield (APY): Compare APYs across different banks.

- Introductory Rates: Be mindful of promotional rates that may expire after a certain period.

Fees and Charges

Financial institutions may charge various fees. It is important to understand these to avoid unnecessary expenses:

- Monthly Maintenance Fees: Opt for accounts that waive these fees.

- Withdrawal Limits: Check for restrictions on the number of withdrawals per month.

- Minimum Balance Requirements: Look for accounts with low or no minimum balance requirements to avoid penalties.

Accessibility

Immediate access to funds is imperative in emergencies.

- Online and Mobile Banking: Ensure the account offers robust digital banking services.

- ATM Access: Verify the network of ATMs available and any associated fees.

- Branch Access: Consider if having physical branch access is necessary.

Account Type

Different types of savings accounts serve varied purposes. The right choice depends on individual needs:

- Traditional Savings Accounts: Basic accounts with easy access but potentially lower interest rates.

- High-Yield Savings Accounts: Provide better interest rates but may come with higher requirements.

- Money Market Accounts: Typically offer higher interest rates and check-writing capabilities but may have higher balance requirements.

Federal Insurance

Safety is a primary concern when choosing an account.

- FDIC Insurance: Ensure the account is insured by the Federal Deposit Insurance Corporation up to $250,000.

- NCUA Insurance: If considering a credit union, confirm insurance from the National Credit Union Administration.

Additional Features

Evaluate additional benefits that may enhance the account’s utility:

- Automatic Transfers: Accounts offering automated transfers from checking accounts can simplify the saving process.

- Alerts and Notifications: Useful for managing account activity and maintaining balance requirements.

- Customer Service: Assess the responsiveness and quality of customer service.

Before finalizing a choice, thorough research and comparison of available options are advisable. Consulting financial advisors or utilizing online comparison tools can assist in making an informed decision.

Automating Your Savings: Strategies to Build Consistency

Automating savings ensures that individuals remain consistent in their efforts to build an emergency fund. This approach minimizes the risk of forgetting to save and leverages technology to make the process seamless.

1. Set Up Direct Deposits:

One effective method is to arrange for direct deposits from the paycheck directly into a savings account. This can be accomplished by contacting the human resources department to specify the percentage or amount to be transferred into the emergency fund account. By doing so, a portion of income is saved before it even touches the checking account.

2. Utilize banking tools:

Banks and credit unions often provide tools for automatic transfers and savings. By setting up recurring transfers from a checking account to a savings account, individuals can ensure that funds are regularly allocated towards their emergency fund. These transfers can be scheduled weekly, bi-weekly, or monthly to match the individual’s pay schedule.

3. Leverage financial apps:

Various financial apps are designed to help automate savings. Applications like Qapital, Acorns, and Digit automatically monitor spending and transfer small amounts into savings based on user preferences. These apps round up purchases to the nearest dollar or save specified amounts regularly, making the process effortless.

4. Create a budget with savings goals:

Developing a budget that incorporates savings goals is another critical strategy. By allocating specific portions of the budget towards the emergency fund, individuals ensure that savings are not an afterthought. Tools like Mint or YNAB (You Need A Budget) offer features for tracking savings goals and automating transactions accordingly.

Without a budget, it is easy to lose track of spending and fall short on savings goals. Prioritizing the emergency fund within the budget framework ensures consistent contributions.

5. Adjust and review periodically:

Regular reviews of automated saving strategies can optimize the process. Life circumstances and financial situations change; thus, it is crucial to adjust automatic transfers to reflect these changes, ensuring the emergency fund grows as intended. Quarterly or semi-annual reviews are recommended to make necessary adjustments.

6. Employer-Based Savings Programs:

Some employers offer savings programs that facilitate the process. These may include programs like Health Savings Accounts (HSAs) or payroll-deduction savings programs aimed at encouraging employees to save effortlessly. Checking with the employer for such options can be beneficial.

Implementing these strategies allows individuals to build consistency in saving for their emergency fund. This methodology capitalizes on automation, reducing the mental burden and making the process systematic.

Cutting Expenses: Finding Extra Cash to Boost Your Fund

Creating an emergency fund requires identifying potential areas to cut expenses. This process begins with a thorough examination of current financial habits and making necessary changes.

Analyzing Spending Patterns

- Review Bank Statements: Assess monthly bank statements to identify recurring payments that might be unnecessary.

- Track Daily Expenses: Use apps or a financial journal to monitor daily expenditures and pinpoint non-essential spending.

Reducing Discretionary Spending

- Limit Dining Out: Prepare meals at home more frequently to reduce the expense of eating at restaurants.

- Entertainment Adjustments: Consider cheaper alternatives for entertainment, such as streaming services instead of cable.

- Cut Back on Subscriptions: Reevaluate the necessity of multiple streaming services, magazines, or gym memberships.

Saving on Utilities

- Energy Efficiency: Implement energy-saving practices such as using LED bulbs and unplugging devices when not in use.

- Monitor Thermostat: Adjust the thermostat settings slightly to save on heating and cooling costs.

- Water Conservation: Reduce water usage by fixing leaks and using water-efficient fixtures.

Shopping Smartly

- Make a List: Stick to a shopping list to avoid impulse purchases.

- Use Coupons and Discounts: Take advantage of coupons, sales, and discount codes wherever possible.

- Buy in Bulk: Purchase non-perishable items in bulk to save money over time.

Transport Savings

- Carpooling: Share rides with colleagues or friends to cut down on fuel costs.

- Public Transportation: Utilize public transportation modes as a cost-effective alternative to driving.

- Biking or Walking: Embrace healthier, cost-saving options like biking or walking for short distances.

Debt Management

- Lower Interest Rates: Contact lenders to negotiate lower interest rates on current debts.

- Consolidate Debts: Consider debt consolidation for more manageable and potentially lower payments.

Negotiating Bill Reductions

- Review Plan Options: Regularly review and opt for less expensive plans or providers for services like cell phone, internet, and insurance.

- Ask for Discounts: Call service providers and request discounts, especially if you are a long-term customer.

By thoroughly evaluating and adjusting spending habits, considerable savings can be reallocated to build a robust emergency fund. Each small change in daily, weekly, and monthly routines accumulates to create significant expense cuts over time, effectively boosting the emergency fund.

Increasing Your Income: Tips to Accelerate Your Savings

Building an emergency fund relies not only on cutting costs but also on increasing income streams. Here are some strategic approaches to supplementing existing earnings:

1. Optimize Your Current Job

- Negotiate a Raise: Professionals should research industry salary standards and showcase their value to negotiate a pay increase.

- Seek Promotions: One should aim for higher positions within the organization by expanding skills and assuming additional responsibilities.

- Pursue Professional Development: Employees can enroll in courses or certifications related to their field, enhancing qualifications and income potential.

2. Explore Side Gigs

- Freelancing: Professionals with skills in writing, graphic design, programming, or digital marketing can take on freelance projects.

- Consulting: Seasoned experts may offer consulting services to other businesses or individuals, especially in areas like human resources or financial planning.

- Gig Economy Jobs: Platforms such as Uber, TaskRabbit, or Instacart allow for flexible, part-time work.

3. Invest Wisely

- Stock Market: Investing in stocks could yield substantial returns over time. Novice investors should consider using robo-advisors or seeking guidance from financial advisors.

- Real Estate: Renting out a property, or even house hacking (renting out part of a home), can generate passive income.

4. Monetize Hobbies

- Crafts and Art: Selling handmade items or art on platforms like Etsy can turn a passion into profit.

- Blogging or Vlogging: Building an online presence through blogs or YouTube channels, combined with ad revenue and sponsorships, can be profitable.

- Tutoring and Teaching: Sharing knowledge in areas such as music, languages, or academic subjects can be a reliable income source.

5. Utilize the Sharing Economy

- Rent Assets: Homeowners can rent out unused spaces via Airbnb or rent equipment and tools through local platforms.

- Car Sharing: Listing a vehicle on car-sharing services allows individuals to earn from an otherwise idle asset.

6. Leverage Technology

- App-Based Earnings: Using cashback apps, survey apps, or selling items through online marketplaces can provide additional income.

- Remote Work Opportunities: Remote job boards offer opportunities in fields like customer service, data entry, or virtual assistance.

By actively pursuing multiple income sources and using strategic investments, individuals can significantly accelerate the growth of their emergency funds.

Monitoring and Adjusting Your Contributions

Maintaining an effective emergency fund requires ongoing monitoring and adjustments. Being proactive in managing these contributions is crucial to ensuring financial security.

Regularly review financial goals:

Individuals should schedule periodic reviews, such as quarterly or biannually, to reassess their financial goals.

Goals may change due to shifts in personal circumstances, such as a new job, unexpected expenses, or a change in living situation.

Track savings progress:

Keeping track of the saved amount toward the established target helps in understanding progress.

Tools like budgeting apps or financial planners can provide visual aids to illustrate savings trends over time.

Adjust Contributions Based on Income Fluctuations:

Income variations, be they raises, bonuses, or freelance income changes, should be a signal to adjust contributions.

An increase in income should ideally lead to increased contributions, while a decrease might necessitate a temporary reduction.

Account for Inflation:

Adjust the savings goal periodically to account for inflation, ensuring the emergency fund’s purchasing power remains adequate.

Use metrics such as the Consumer Price Index (CPI) to gauge necessary adjustments.

Analyze monthly expenditures:

Regularly review and analyze monthly expenditures to identify opportunities for increasing contributions.

Substitute discretionary spending for emergency fund contributions without compromising essential needs.

Emergency Withdrawals:

Document every withdrawal made from the emergency fund, including the reason and amount.

Ensure withdrawals are replenished to maintain the fund’s integrity.

Feedback Loop:

Establish a feedback system where contributions and fund health are discussed with a financial advisor, if necessary.

Consider advice on optimizing fund growth, accounting for market changes, and personal finance strategies.

Stay Informed:

Keep abreast of financial news and economic indicators that might impact one’s ability to save or necessitate emergency fund usage.

Workshops, webinars, and online resources can provide ongoing education and strategies for effective fund management.

Evaluate Investment Opportunities:

Evaluate low-risk investment opportunities for the emergency fund to ensure growth with minimal risk.

A blended approach with high-liquidity accounts could potentially yield better returns.

By following these steps, individuals can ensure their emergency fund remains robust and capable of addressing unforeseen expenses without financial strain. Proactive management is key to sustaining long-term financial health and stability.

Using Your Emergency Fund Wisely: When and How to Access It

An emergency fund serves as a financial safety net, and using it wisely ensures long-term stability. Identifying genuine emergencies is crucial. Typical scenarios that justify tapping into an emergency fund include:

- Unexpected Medical Expenses: Situations not covered by insurance, such as emergency surgeries or unexpected treatments.

- Job Loss: Income loss due to unemployment necessitates using the fund to cover essential living expenses.

- Major Car Repairs: Costs arising from unexpected breakdowns are vital for commuting to work.

- Critical Home Repairs: Immediate repairs are required for safe living, like a faulty heating system in the winter.

- Family Emergencies: Unanticipated expenses, like funerals or severe illness in the family.

When considering accessing the fund, it’s essential to evaluate the situation critically.

- Assess the Urgency: Determine if the expense is genuinely immediate or if there’s time to explore other financial options.

- Explore Alternatives: Before withdrawing, identify if alternative methods like insurance claims, payment plans, or community resources can address the issue.

- Calculate the amount needed. Only withdraw the necessary amount to cover the emergency, preserving the fund’s longevity.

- Reevaluate Budget: Adjust monthly spending to minimize further withdrawals and maintain the fund.

Using automation can aid in maintaining the emergency fund.

- Set Up Alerts: Create bank alerts for low balances to prevent overdrawing.

- Automatic Savings: Schedule automatic transfers to rebuild the fund post-withdrawal.

Always remember the purpose of the emergency fund:

“The emergency fund is not for discretionary expenses or wants; it’s for true financial crises.”

Replenishing the fund promptly after usage is vital. Strategies include allocating bonuses, tax refunds, or increasing contributions temporarily. Additionally, maintaining financial discipline by differentiating between wants and needs keeps the fund intact for future exigencies.

Proper utilization of the emergency fund creates a cushion against unforeseen events, fostering financial resilience and peace of mind. This approach not only provides immediate relief during emergencies but also ensures ongoing financial health and stability.

Replenishing Your Emergency Fund After an Emergency

After utilizing the emergency fund, it is essential to replenish it to maintain financial security. This section provides a structured approach to restoring the fund effectively.

- Evaluate the Impact: Start by assessing the extent of the emergency’s impact on the fund. Calculate the total amount withdrawn and identify any remaining balance. This will help in setting a clear replenishment goal.

- Adjust Budget: Reallocate portions of the monthly budget to prioritize the emergency fund. Consider temporarily reducing discretionary spending.

- Reduce entertainment expenses.

- Limit dining out and opt for home-cooked meals.

- Postpone non-urgent purchases.

- Automate Savings: Set up automatic transfers from checking to the emergency savings account. Automation ensures consistent contributions and reduces the temptation to spend the allocated funds.

- Increase Income: Find opportunities to boost income.

- Take on additional shifts or part-time jobs.

- Explore freelance opportunities based on skills.

- Sell unused items online to generate extra cash.

- Allocate Windfalls: Use unexpected income, such as bonuses, tax refunds, or gifts, to accelerate the replenishment process. Direct a significant portion of these windfalls straight into the emergency fund.

- Monitor Progress: Regularly review the rebuilding progress. Utilize financial tracking tools or apps to maintain oversight and ensure the plan stays on track.

- Stay Committed: Patience and consistency are vital. Acknowledge that replenishing the fund may take time but is a crucial step for long-term security. Stay motivated by revisiting the purpose of the emergency fund and the peace of mind it provides.

Practical Tips for Success

“The key to improving financial health is persistence and adaptability. Adjustments might be necessary, but the end goal remains worthy.”

By following these strategies, the emergency fund can be restored efficiently, ensuring continued financial stability.

Additional Tips for Maintaining Financial Security

Ensuring ongoing financial stability goes beyond just creating an emergency fund. Here are several essential tips for maintaining financial security:

Automate Savings:

Set up automatic transfers from the checking account to the savings account. This ensures consistency in savings without relying on willpower.

Diversify income streams:

Relying on a single source of income can be risky. Consider freelance work, side businesses, or investments to create multiple income streams.

Regularly Review Financial Plans

: Financial goals and circumstances change over time. Regular reviews can help adjust savings strategies and ensure goals remain on track.

Limit Debt:

Prioritize paying down high-interest debt. Maintain a balance between saving and debt reduction to preserve financial health.

Monitor credit reports:

Regular checks for inaccuracies and signs of fraud can protect credit scores, which are vital for securing favorable loan terms and interest rates.

Invest in Education:

Continued learning can increase earning potential and job security. This can include earning additional degrees, attending workshops, or obtaining certifications.

Maintain adequate insurance.

Health, auto, home, and life insurance can prevent financial devastation due to unexpected events. Regularly review and update policies to ensure adequate coverage.

Build a budget:

A detailed budget helps track income and expenses, ensuring that spending aligns with financial goals. Apps and software can simplify the budgeting process.

Emergency Fund Growth:

Once the initial emergency fund goal is met, continue contributing to build a larger cushion. Shift some funds into higher-yield savings accounts or safe investments for growth.

Stay informed about financial changes:

Keep abreast of changes in tax laws, interest rates, and economic conditions that could affect personal finances. Adjust strategies accordingly.

“It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.” – Robert Kiyosaki

Implementing these additional measures can further fortify financial security, ensuring preparedness for any financial challenges that may arise.

Conclusion: Achieving Peace of Mind through Financial Preparation

Financial preparation for unforeseen circumstances can significantly enhance an individual’s sense of security and well-being. An emergency fund is the cornerstone of this financial stability. By diligently saving, individuals can meet unexpected expenses without disrupting their long-term financial goals. Establishing an emergency fund involves deliberate steps that include assessing one’s financial situation, setting realistic savings goals, and consistently depositing into a designated account.

To achieve peace of mind through financial preparation:

1. Assess the financial status

Individuals should start by examining their current financial situation. This includes evaluating income streams, monthly expenses, and existing savings. Understanding the baseline is crucial to setting achievable targets.

2. Set clear savings targets

Defining a specific goal for the emergency fund is vital. Most financial experts recommend saving three to six months’ living expenses. This provides a benchmark for individuals to aim for.

3. Automate Savings

Automating savings ensures consistency in building the emergency fund. Setting up automatic transfers from a checking account to an emergency fund account can prevent the temptation to spend.

4. Choose the right account

Selecting the appropriate account for the emergency fund is crucial. High-yield savings accounts, money market accounts, or other liquid and interest-bearing options are typically recommended. These accounts should offer easy access in times of need.

5. Regularly review and adjust

Periodic reviews of one’s financial status and adjustments to savings goals ensure that the emergency fund remains relevant and sufficient. Changes in lifestyle, income, or expenses should reflect the fund’s size.

6. Avoid using credit

Relying on credit cards or loans during emergencies can lead to debt accumulation. An adequately funded emergency fund provides a buffer, allowing individuals to manage unexpected costs without incurring debt.

7. Involve the entire family

Financial preparedness should be a household effort. Involving the entire family in the process fosters a collective understanding and commitment to financial security.

8. Build Gradually

It is essential to recognize that building a substantial emergency fund takes time. Consistent, small contributions are better than sporadic, large deposits. The key lies in maintaining a steady and disciplined approach.

In conclusion, achieving peace of mind through financial preparation requires dedication, discipline, and strategic planning.

read article about Understanding Personal Loans: What You Need to Know in 2024

One Comment